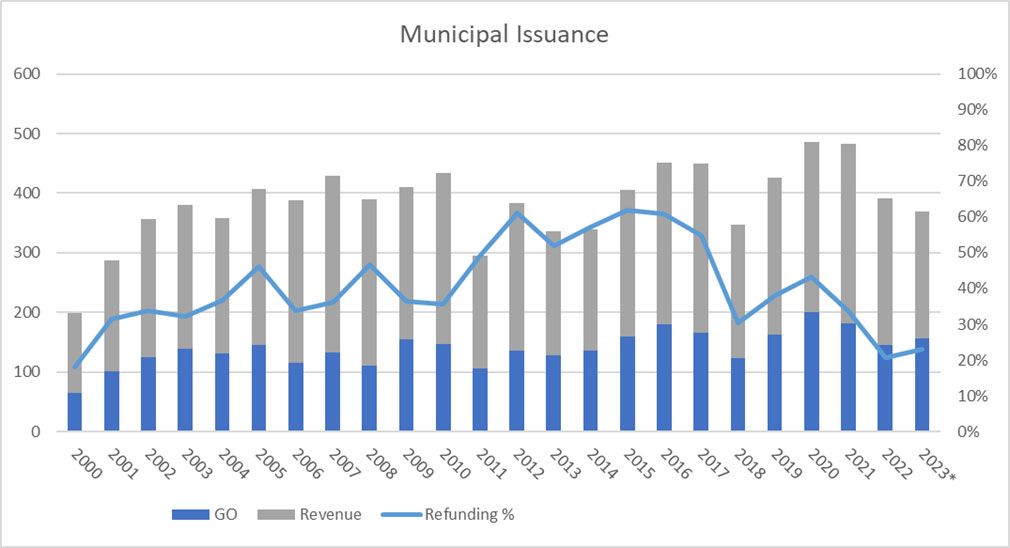

Bond refinancings or “refundings” are used by municipalities to save debt service costs on outstanding bonds or to modify certain bond covenants or financing terms. During the decade preceding 2022, refunding bonds represented over 49% of the annual issuance of municipal bonds, on average, according to SIFMA.

However, refunding issuance has recently dropped significantly, with only about $81 billion of municipal refunding bonds issued, or about 20% of total municipal issuance in 2022. This is largely a result of higher interest rates that have eliminated potential savings from refinancing. But the eradication of tax-exempt advance refunding options by the 2017 Tax Cuts and Jobs Act also played a large role in the decline of refunding activity. As you can see in the chart, refunding issuance as a percentage of total issuance plunged in 2018 compared to 2017 levels.

Annualized using 2023 data through Sept. 30, 2023, courtesy of SIFMA.

Some issuers are turning to tender offers as a creative way to potentially restructure or repay their debt. A tender offer is an offer made by an issuer to purchase back certain bonds from bondholders at a specific price and on a specific date.

In today’s rate environment, the tender offer price is typically discounted from par but is usually better than the prevailing market price. This enables issuers to find savings arising from a low purchase price despite higher market rates while also enticing bondholders with a better deal than the market provides.

Bondholders must either accept or reject the offer as it stands, but bondholders who do not wish to sell have no obligation to do so. Tender offer proposals contain specific instructions to follow to accept the offer and complete the sale while declining the tender offer usually requires no action from the bondholder.

Tender offers may also serve as a workaround to achieve a tax-exempt advance refunding. The tax code does not allow two tax-exempt bonds to be outstanding at the same time for a period of more than 90 days for the same initial funding purpose. Since the existing bonds are purchased back by the issuer and would no longer be outstanding, the new bonds may be issued as tax-exempt rather than taxable.

Some taxable advance refunding bonds issued in recent years have been converted back to tax-exempt bonds using tender offers. In those cases, issuers may realize savings from a discounted purchase price as well as a more favorable rate on the tax-exempt bonds than the previously taxable bonds.

Bondholders who receive a tender offer on a bond should carefully consider the offer, taking into account the bondholder’s investment strategy and pondering the following questions:

- Will you possibly want or need to sell this bond? If so, what is the lowest price you would accept? Is the offer price more or less than your bottom price?

- Bondholders looking to sell that bond may be able to obtain a higher price through the tender offer than they would achieve by simply selling the bond in the open market.

- What is the likelihood of the bond being called in a lower rate environment? Do you view a lower rate environment as likely?

- Bondholders may want to participate in the market at today’s rates rather than risk rates declining and the bond being called, and then reinvesting at lower market rates. Issuers who entertain tender offers tend to be efficient and would likely call bonds once eligible if it made financial sense.

- Would you prefer to keep this bond if it became defeased? What is the probability of the bond being defeased?

- Some issuers intend to advance refund the balance of bonds not purchased back using a taxable bond issue if a large enough portion of bondholders accept the tender offer. This means that bondholders who don’t accept the tender offer may end up with a defeased bond, which has essentially no credit risk and typically trades with tighter spreads.

Tender offers can represent a good opportunity for certain bondholders, but bondholders who are happy with their investment and wish to keep it may decline the tender offer. Bondholders should consider the offer and determine the best course of action based on their rate outlook, investment strategy and liquidity position.

Dana Sparkman, CFA, is senior vice president, municipal analyst in The Baker Group’s Financial Strategies Group. She manages a municipal credit database that covers more than 150,000 municipal bonds, providing clients with specific credit metrics essential in assessing municipal credit.

Email Dana at Dana@GoBaker.com