In a rising rate environment, bonds priced at a discount become more prevalent. Therefore, it is imperative that municipal bond investors consider the tax implications of purchasing municipal bonds at a discount. Discounts that occur in the secondary market are known as “market discounts.” Those that occur at issuance are known as “original issue discounts.” The nature of the discount is key to determining the after-tax yield.

Market Discount

If the discount is due to market factors, the difference between the accrued discount price at the disposal date and par is taxed as ordinary income. Examples of market factors include changes in yield levels and credit quality.

Individual investors may be able to pay their capital gains tax rate on small discounts instead of their ordinary income tax rate. This is known as the “de minimis rule.” Specifically, if the discount is less than .25% multiplied by the number of full years until maturity times the par value, the discount is considered small.

The difference between the discount price and the par value may be treated as a capital gain and taxed at the corresponding capital gain rate rather than the ordinary income tax rate by individual investors. However, taxes due on all market discounts are taxed as ordinary income for financial institutions.

Original Issue Discount (OID)

If the bond was issued at a price less than par, then the discount is treated as interest. For a tax-exempt municipal bond, the discount would not be taxed. Zero coupon bonds represent common examples of bonds that have an OID, but there can be an OID for coupon-paying bonds as well. As time progresses after issuance, the accrued interest is added to the issue price to adjust the tax basis of the bond, and the result is known as the “revised issue price.”

If an OID bond is purchased in the secondary market, then a market discount may also be present if the discount is deeper than the revised issue price. The market discount is taxed as ordinary income, and the OID is taxed as interest.

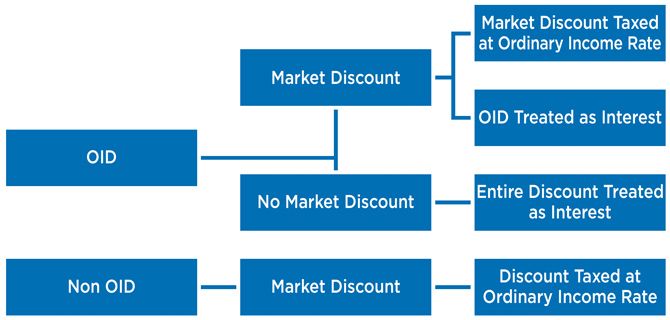

The process of determining the tax implications of discount municipal bonds for financial institutions is summarized in Exhibit 1 and the specific examples that follow.

Exhibit 1

Example 1 — Bond issued at par and purchased at a discount

Issue Price: $100

Purchase Price: $99

The purchase price is less than the issue price; therefore, the discount is a market discount. The difference between the purchase price and the issue price is taxed as ordinary income.

Example 2 — OID bond purchased below the revised issue price

Issue Price: $60

Revised Issue Price: $65

Purchase Price: $64

The purchase price of $64 is less than the revised issue price of $65, so there is a market discount present in addition to the OID. The market discount of $1 ($65-$64) is taxed as ordinary income while the remainder of the discount is taxed as interest.

Example 3 — OID bond purchased above the revised issue price

Issue Price: $60

Revised Issue Price: $65

Purchase Price: $70

The purchase price of $70 is greater than the revised issue price of $65, so the entire discount is attributable to the OID and is treated as interest.

Increasing yield levels may create complicated tax scenarios for some municipal bonds, but the after-tax yields will often remain attractive to investors. Investors should consider all tax implications when making investment decisions, including additional taxes due on market discounts.

Dana Sparkman, CFA, is senior vice president, municipal analyst in The Baker Group’s Financial Strategies Group. She manages a municipal credit database that covers more than 150,000 municipal bonds, providing clients with specific credit metrics essential in assessing municipal credit.

Email Dana at Dana@GoBaker.com.

The Baker Group is a Preferred Service Provider of the Indiana Bankers Association and an IBA Diamond Associate Member.