Indiana’s agricultural heritage is deeply rooted, with farms and agribusinesses playing a pivotal role in the state’s economy. The state ranks high in the production of corn, soybeans, hogs and poultry, making it a key player in the nation’s agricultural landscape. Additionally, agribusinesses such as food processing, equipment manufacturing, and agricultural research and education further bolster the industry’s impact.

Local community banks play a crucial role in supporting these sectors by providing tailored lending options. These banks understand the unique financial needs and challenges faced by farmers and agribusiness owners, offering them essential financial support to sustain and grow their operations. This support is vital for the continued success and resilience of Indiana’s agricultural sector, ensuring its sustainability for generations to come.

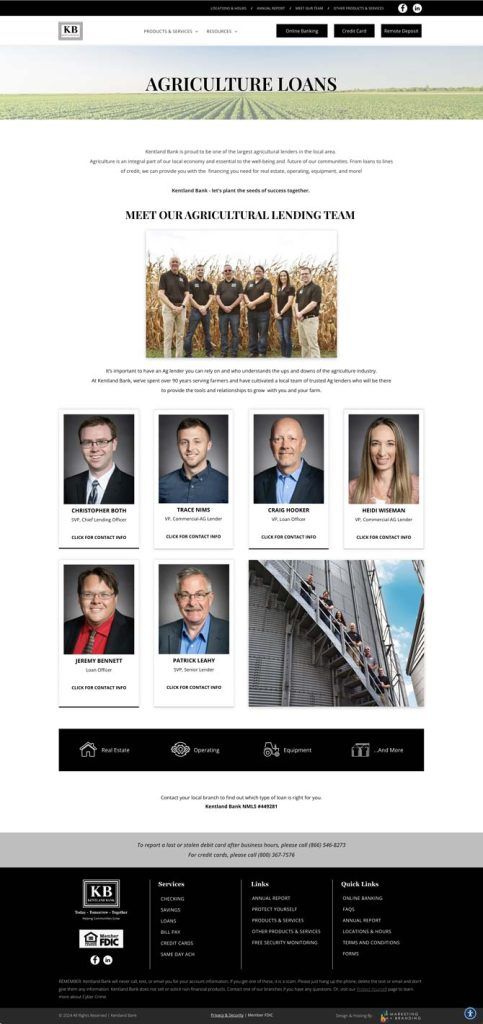

At K4 Marketing + Branding, we recognize the importance of tailored strategies to meet the unique needs of different industries served by community banks. Recently, we had the opportunity to work with IBA member Kentland Bank on an integrated marketing campaign targeted at the agricultural lending sector. At campaign inception, portraying both relatability and reliability to the target audience was paramount for success, positioning the bank as a partner that the local agricultural community can depend upon for their financial needs. Farmers and agribusiness owners often value reliability and trustworthiness in their banking partners, as these qualities are essential for their financial stability and business success. By emphasizing this in the campaign, Kentland Bank established itself as a financial institution that understands the unique needs of the agricultural community. The planning stages of the campaign were spearheaded by the need for consistent messaging that highlighted the bank’s history of serving local farmers, its commitment to providing personalized lending solutions and its track record of supporting the local agricultural economy.

A well-coordinated marketing plan is crucial to maintaining a consistent brand experience across both physical and digital marketing platforms, and instilling trust and credibility with your audience. Kentland Bank exemplified this by integrating a mix of various marketing vehicles to drive traffic and engage farmers and agribusiness owners. This approach amplified their message and increased brand visibility within the local agricultural community. Their campaign included tailored direct mail, thoughtfully timed social media content and an improved website experience. Radio ads featuring their local ag lending team members reinforced the bank’s community roots, airing during prime and agriculture programming times to increase campaign reach and exposure.

The success of this campaign highlights the effectiveness of a targeted marketing approach, demonstrating how a keen understanding of the audience and promoting brand consistency across multiple channels can engage them effectively. Overall, integrated marketing efforts are highly effective in serving certain industry sectors, such as agriculture. By combining multiple channels and tactics, these initiatives can reach a wider audience and provide a unified brand experience. Kentland Bank’s successful strategy serves as a testament to the impact of integrated marketing in serving vital industry sectors and positioning community banks as thought leaders, pillars of community support and local resources within their respective locales.

Looking beyond the agricultural sector, the principles of integrated marketing showcased in Kentland Bank’s campaign can be applied to other industries as well. By understanding the unique needs of your target audience and leveraging a mix of channels, community banks serving other sectors can engage their audience effectively and enhance their brand presence. Whether it’s through traditional or digital marketing platforms, the key is to create a seamless and consistent brand experience that resonates with both current and prospective customers and promotes lasting relationships.

The campaign included featuring the bank’s ag lending team members in ad creatives like these.

Nicole has more than 20 years of experience working in the marketing field and 12 in the financial services industry. She joined K4 Architecture + Design in 2012 and co-founded the Marketing + Branding arm in 2022.

Email Nicole at NDeRogatis@K4Architecture.com.

K4 Marketing + Branding is a division of K4 Architecture + Design, a Preferred Service Provider of the Indiana Bankers Association and an IBA Diamond Associate Member.