The Fraud Odyssey

He served as a World War II pilot in the U.S. Army Air Corps when he was 18 years old, flying multiple missions and training new pilots as the war waged on for more years than anyone thought. He returned stateside after the war ended, married his sweetheart, started a family and started a heating and air conditioning company with job sites throughout the Midwest.

He actively worked at the company he started until his 92nd birthday. He wasn’t as strong, but he still had the wisdom and respect of his employees and customers. At 92, he said, “It’s time to retire.” Then came the daily coffee and breakfast at McDonald’s. The table of veterans surrounding the breakfast McMuffins and telling stories was a fixture for all the staff and customers, so much so that on his 98th birthday, local TV news featured him on the nightly broadcast and McDonald’s organized a tribute breakfast and invited the community.

Unfortunately, his health took a downturn that same year, and he moved into the home of his daughter and son-in-law. He didn’t sell his ranch home and five acres, as he still went down to the old house occasionally to tinker.

Unbeknownst to him, a criminal ring with ties to Indiana and Ohio was watching the home as well. They saw it unoccupied most days and pounced, breaking in and stealing financial documents and old checkbooks the family didn’t know were still in the house. Within hours of the burglary, online and credit bureau inquiries had been filed. The fraud fuse was lit.

The drive-through teller at a local bank became suspicious when someone came to their window presenting a check as if written by their 98-year-old customer. The payee claimed it was for painting a house. The teller called the number they had on file for the veteran, speaking to his daughter, who had been added to the account. Neither she nor her father knew anything about the check or the payee. The bank called the police, but the perpetrators took off before officers arrived.

A seven-month odyssey of fraud ensued, highlighting many of the macro issues facing banks challenged by the marketplace to make opening accounts and transacting business online faster and faster with less and less friction, and a criminal justice system that is not equipped or inclined to help.

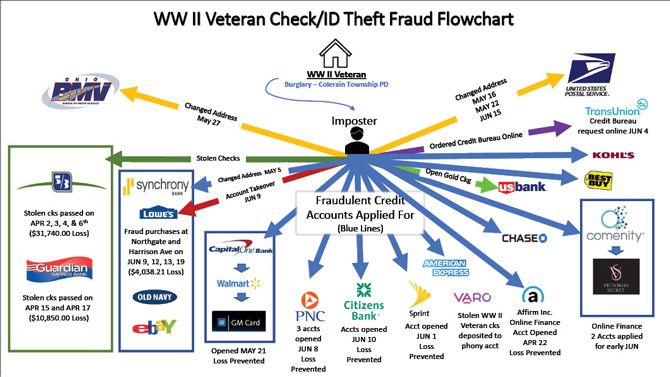

Chart 1, seen below, was created to try to persuade the FBI to take the case due to its overwhelming interstate nature, complexity, and the continuation of the fraud attempts as victims fought the fraud daily, not unlike “Whack-a-Mole.” Even with the victim being a decorated WWII veteran, the one time he called upon his country for help, they turned him away, saying, “We can’t work the case unless the loss exceeds $1 million.” The family was left to fight banks, credit card companies and lenders where accounts were opened using the victim’s name and personal identifiers at record speed, while the perpetrators continued their fraud unabated.

Chart 1

This chart, produced by Jim Rechel for use by law enforcement and court presentations as part of a victim impact statement, shows changes of address at BMVs and the U.S. Postal Service, fraudulent checking accounts, forged checks, credit cards and credit bureau requests from the victim’s case.

Attempts to report the fraud to financial institutions often took days and multiple phone calls despite the fraudulent accounts being opened in mere minutes. In one instance, a bank refused to take a fraud report until they could identify the victim through a driver’s license and video face identification. When the verification camera link did not function properly, the bank asked the now 99-year-old to go outside and have his daughter film him via the fraud reporting portal. Only after their facial recognition system confirmed his photo was the same as the driver’s license the victim supplied would the bank take a fraud report. This process took more than three hours to complete.

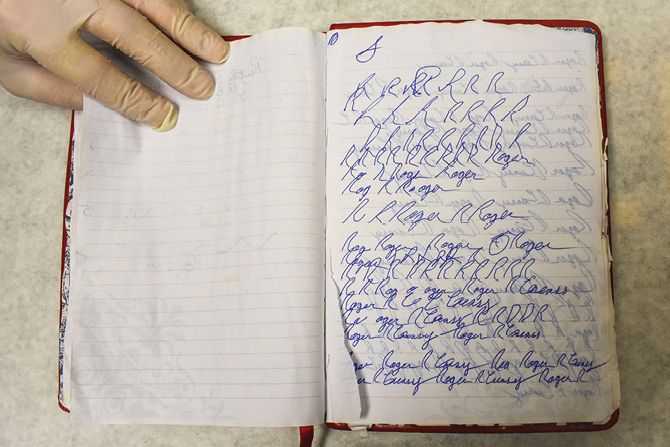

This law enforcement-provided photo shows one of numerous journals they found containing hundreds of pages that criminals used to practice the signatures of their victims.

Ultimately, a dedicated lieutenant with a local police department worked with the family and a U.S. postal inspector I knew worked with me to identify the perpetrators. After two years of continuing fraud, eight people were later identified and prosecuted in state courts in Ohio and Indiana. They received 6-8-year sentences. One of the main participants has a criminal record, including drug dealing and homicide, and he knew how to stay in the background. Fortunately, he was convicted in other courts of criminal activity unrelated to this ring and is in prison for an extended period.

What the Investigation Results Reveal for Bankers

While the fraud illustrated above is a solitary case, in a world of millions of fraud cases per year, it reflects macro changes taking place in the world of fraud, specifically the following:

- The increasing knowledge and sophistication of the criminal rings targeting banks and their customers.

- The speed at which criminals operate to monetize their stolen information, documents and personally identifiable information.

- The speed at which bank transactions move (think FedNow and other Fed changes to “Instant Payments” initiatives).

- The inability of law enforcement and the criminal justice system to respond to the fraud epidemic.

- The evolution of “street criminals” to highly organized cyber-savvy fraud rings.

- The overall moral decline in the marketplace and its implicit invitation to get “easy money.”

- Identifying and authenticating identities for account openings and transactions.

What Bankers Need to Address

Identifying steps your bank can take to address the rapid changes taking place will involve:

- Investments in technology and fraud personnel equipped to use predictive modeling and AI.

- Customer dashboards incorporating transaction and maintenance activity as part of fraud strategy.

- Development of a fraud strategy, to include the level of support and advocacy the bank will provide to victim customers.

- A systematic approach to the consolidation of fraud methods in real-time to respond to threats more quickly.

The recounted Fraud Odyssey highlights the challenges faced by individuals and financial institutions in the evolving fraud landscape. The story of a WWII vet falling victim to financial exploitation exposes system gaps and the growing sophistication of criminals. It underscores the urgency for banks to adapt, invest in technology, use AI and establish robust fraud strategies.

Creating a supportive environment for victims is crucial. This case is a reminder to address moral decline and fortify defenses against fraud, urging banks to adopt proactive solutions in combating modern-era challenges.

HB Digital Extra

Learn more about the changing fraud landscape, law enforcement challenges, a one-hour fraud mitigation webinar and more.

Victim Perspective

Gary Shildhorn, a Philadelphia attorney, testified before the Senate Special Committee on Aging on Nov. 16, 2023, after he was the attempted victim of a scam. Sen. Mike Braun, R-Ind., is the ranking member of the committee. Shildhorn concluded his testimony by saying, “I understand that there are economic benefits to a monetary transfer system, like cryptocurrency, that avoids the regulated bank industry. It is also manifestly apparent that this technology, along with AI technology and burner phones, provides a riskless avenue for fraudsters to prey on us.

I doubt that the commercial benefits of cryptocurrency could ever outweigh the economic and social harm it causes. A fundamental foundation of our system is that if you are harmed, a remedy is available through the courts or law enforcement. Unfortunately, that is not the case here.”

Jim is president of The Rechel Group, a leading risk consulting business specializing in fraud risk analysis, fraud prevention, detection and investigation services. He has served as conference emcee for the IBA Security & Technology Conference for 20+ years and is a regular presenter at other IBA conferences and events.

Email Jim at JimRechel@RechelGroup.com.