The banking industry has always been highly competitive and is more so now with the proliferation of consumer options that include non-bank financial services companies, fintech innovators and niche lenders. On average, consumers own 5.3 accounts across all types of financial institutions. Increased marketing noise is also adding to the challenge of standing out from this crowd. The amount that U.S. banks spent on marketing across the U.S. grew 8% to $22.5 billion in 2024, and money spent on advertising is projected to increase by 20% in the banking and lending sector in 2025, led by larger bank spending. The competitive impact on community banks is even more dramatic.

That said, many community banks dealing with tighter margins and an unpredictable economy face the pressure of holding marketing budgets flat or decreasing overall spending. How does a community bank stay competitive while navigating these challenges? The key is marketing efficiency and ROI.

There are several trends accelerating in the banking and financial services industries that hold great promise for driving marketing efficiency and productivity, including automation, artificial intelligence, advanced data analytics and – probably most tactically important – hyper-personalization.

Let’s start by defining hyper-personalization: Hyper-personalization is a marketing strategy that goes beyond traditional “using their name” personalization by using real-time data, AI and machine learning to tailor content, product recommendations and other information that’s highly specific to the individual. It’s about creating unique, personally relevant experiences that resonate with each customer based on their individual preferences, behaviors and life circumstances.

Traditional personalization approaches have been limited to including a customer’s (or prospect’s) name in an email or relying on surface-level segmentation such as age, income or assets in targeting a marketing message. Two people who look demographically the same on paper may be motivated by very different priorities. Thus, messaging that is effective for one customer may fall flat for the other, and overall results of a campaign are dampened, efficiency is lowered and ROI is diminished.

Hyper-personalization may seem counterintuitive in terms of generating efficiency, requiring the evolution from a singular one-size-fits-all approach to marketing and customer engagement to more versions of a message and a variable channel mix. However, AI and automation can facilitate hyper-personalization without draining the capacity of a marketing team and reduce mass marketing to very targeted delivery (think 500 targeted versus 5,000 mass-marketed).

BY THE NUMBERS

More sophisticated personalization in bank marketing led to:

- 30% more product sales1

- 40% higher revenue2

- 76% more likely to purchase from your brand3

Personalization is tied to high customer satisfaction, which leads to:

- 37% higher average balances4

- 87% more likely to purchase additional products5

- 5.8x more referrals6

1 Boston Consulting Group, 2023

2 McKinsey & Company, 2021

3 McKinsey & Company, 2021

4 Avios, 2024

5 Avios, 2024

6 Harvard Business Review, 2022

Moreover, consumers have come to expect a high level of personalization from businesses across industries, especially through digital communications. Today’s customers, particularly younger generations, expect convenient, fast and digital-first interactions, and digitally native fintech companies are pushing banks to accelerate digital transformation efforts. Hyper-personalization will inevitably move from a trend to table stakes in banking, sooner rather than later.

Banks have a treasure trove of data on their customers, including demographic, socioeconomic and behavioral data (e.g., accounts opened, responses to offers and marketing tactics, etc.), and predictive analytics have proven useful for anticipating customer needs. However, this data does not provide insight into why people behave as they do or their intrinsic motivations. This is the missing component to the greatest level of efficiency.

Harnessing these insights can be powerful for hyper-personalized marketing and customer engagement, but such data are not typically captured in a bank’s customer record. This is where psychographics come in.

Psychographics: Insights Into Action

Psychographics pertain to people’s attitudes, values, personalities and lifestyles, and are core to their motivations, priorities and communication preferences. These drive the reason behind customer decisions and behaviors. Leading companies across industries, such as Procter & Gamble, Porsche and Geico, have used psychographics to develop marketing that resonates on a deep, personal level, achieving remarkable results and enhanced ROIs with very efficient marketing spends. The key is moving the data into actionable knowledge that can be tactically deployed by a community bank.

As an example, Psympl® has developed a powerful psychographic model for the banking and financial services industries – Motivation Intelligence – which provides the insights for message development and delivery that are hyper-personalized for each individual customer. Psympl® identified five distinct segments of people based on their unique approaches to finances and investing, derived from statistically valid national consumer research:

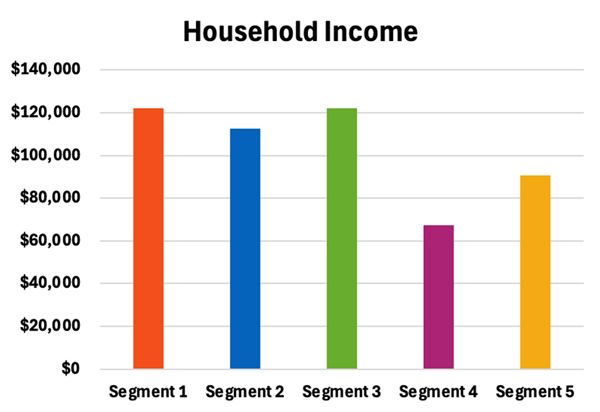

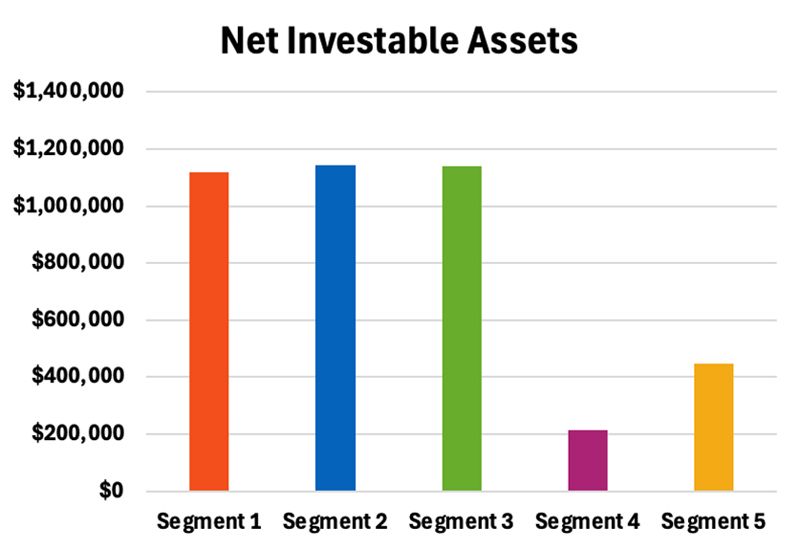

Note that people in segments 1, 2, and 3 have, on average, the same level of income and assets, which is significantly more than the assets owned by people in segments 4 and 5:

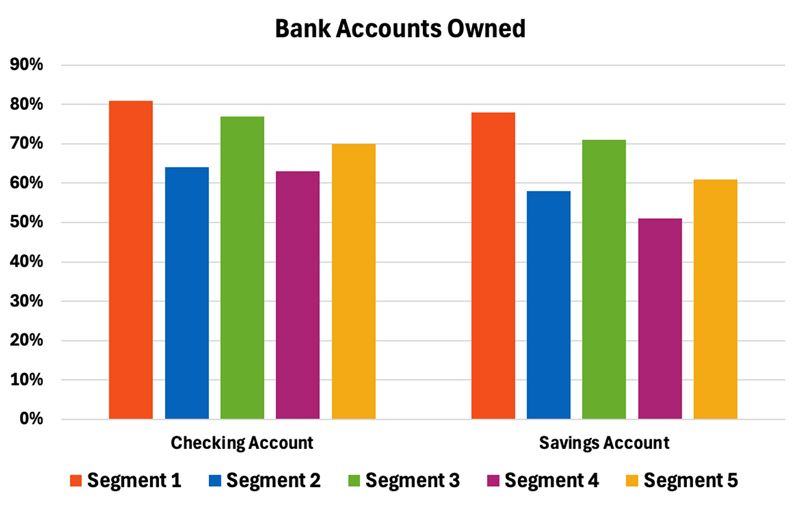

Looking at the five financial psychographic segments’ banking behaviors, the majority of people in each segment own both a checking account and a savings account; however, assets in segments 2 and 4 are significantly underdeveloped relative to the other segments, and people in these two segments have very different financial personalities.

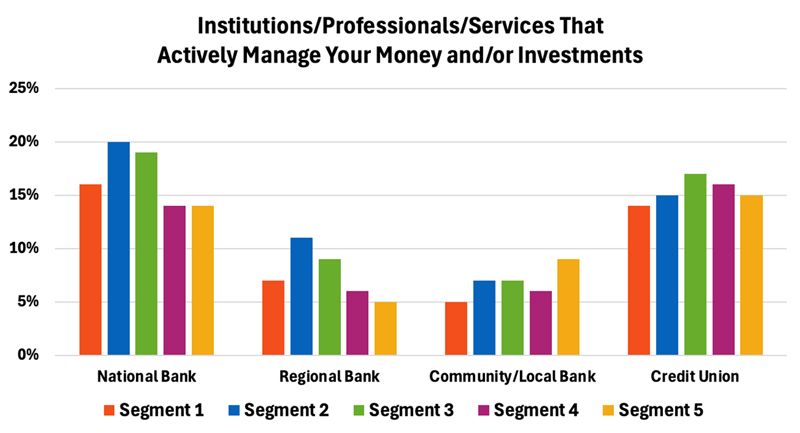

When looking at the types of institutions that actively manage the financial assets of people in each segment, people in segments 2 and 3 are significantly more likely than people in other segments to work with a national bank (assets over $100 billion; e.g., Bank of America, Chase Bank, Wells Fargo, Citigroup, etc.) and a regional bank (assets between $10 billion and $100 billion; e.g., Fifth Third Bank, PNC Bank, etc.). People in segment 5 are the most likely to work with a local/community bank (assets under $10 billion). People in segments 4 and 5 are the most likely to choose a credit union over the other institutions.

This data helps community banks understand the mindset of people in each segment but also highlights opportunities for targeting and conversion. Segments that demonstrate a propensity for certain institutions represent lower-hanging fruit for marketing efforts and greater marketing efficiency and ROI.

This data can also be used to target niche and underserved geographic markets with relevant products and services. While people in segments 1, 2 and 3 are prime prospects for wealth management, those in segments 4 and 5 may benefit from services designed to manage their money better or realize healthier returns.

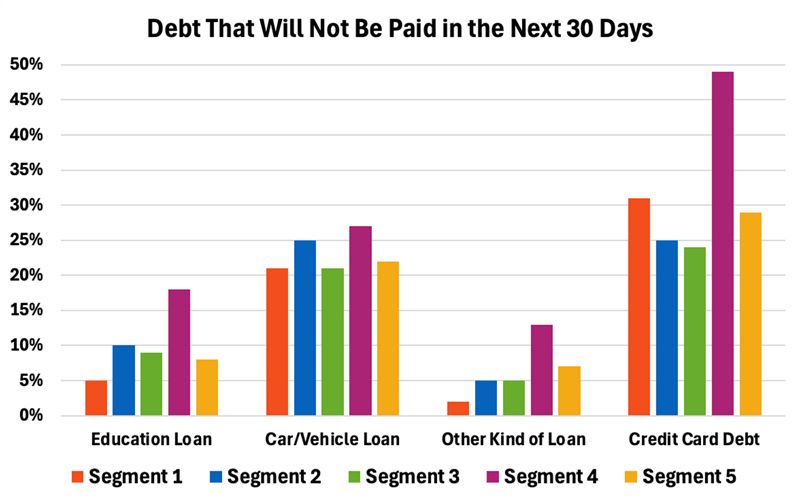

For example, people in segment 4 are significantly more likely to carry some form of ongoing debt and feel overwhelmed by it. People in this segment would greatly benefit from easy-to-use budgeting tools and financial literacy programs focused on practical skills such as budgeting, debt management and understanding credit. Encouraging automated savings plans that deduct small amounts from each paycheck can help them break free from the paycheck-to-paycheck cycle.

People in segment 5 are institutionally suspicious by nature and prefer to manage their money themselves. This is especially true given that even seemingly simple financial matters can have hidden complexities that impact long-term well-being. A community bank could offer complementary financial check-ups to identify potential areas for improvement, such as tax optimization or estate planning, which they may have overlooked. This demonstrates the value of professional guidance.

Summary

Hyper-personalization is a trend that delivers against rapidly evolving customer expectations, customer acquisition and loyalty. Further, it creates marketing efficiency, increased ROI and greater engagement.

Though hyper-personalization can be applied across channels of customer engagement (e.g., face-to-face interactions), it can be accomplished at scale through digital communications and marketing. Psychographics provide the insights to resonate with each customer’s intrinsic motivations, increasing the likelihood of desired behavior activation, such as choosing a bank, buying a product or service, consolidating accounts or staying loyal to a bank for greater lifetime value. This is a proven approach across industries and can be lucrative for innovative community banks looking to stand out in a highly competitive marketplace and without a multi-million-dollar budget.

Hyper-personalization done right is not a nice-to-have; it’s a must-have to compete in today’s banking marketplace. McKinsey & Company summed it up nicely in its April 24, 2025, article “Riding the storm: How consumer finance companies can survive and thrive”:

“But the future of consumer finance isn’t just digital; it’s also Darwinian. Companies that evolve, embracing AI and hyper-personalization, will thrive in this new ecosystem. As for the rest, the extinction event for outdated lending models has already begun.”

Bruce A. Clapp, President, MarketMatch

Bruce is the president of MarketMatch, a digital-first strategic marketing firm focused on accelerating community bank growth through delivering a clear strategic focus, creating internal and marketplace momentum, and delivering results through a guaranteed ROI. Clapp is a nationally noted speaker, author and banking strategy expert.

Email Bruce at DDenton@indiana.bank

Brent Walker, CSO & Co-founder, Psympl®

Brent Walker is the co-founder and chief strategy officer for Psympl®, using psychographic AI to create content that activates consumer behaviors based on their motivations. He spent 20 years at P&G in marketing, leading brands and psychographic initiatives. Walker has been featured in Forbes, Healthcare Finance and The Commonwealth Fund.

Email Brent at Brent@Psympl.ai

MarketMatch is an associate member of the Indiana Bankers Association.