The SECURE Act – officially known as the Setting Every Community Up for Retirement Enhancement Act of 2019 – made significant changes to IRA and retirement plan rules, including to the beneficiary payout options. One of the most noteworthy changes involves the 10-year rule, which requires a total distribution of inherited assets by Dec. 31 of the year containing the 10th anniversary of the account owner’s death.

The SECURE Act also created three groups of beneficiaries: eligible designated beneficiaries, designated beneficiaries and nonperson beneficiaries. This new classification of beneficiaries is important when discussing the 10-year rule.

- An “eligible designated beneficiary” is a spouse, an IRA owner’s minor child, a disabled individual, a chronically ill individual, an individual who is not more than 10 years younger than the IRA owner, or the beneficiary of an IRA owner who died before Jan. 1, 2020.

- A designated beneficiary is an individual who is not an eligible designated beneficiary.

- A nonperson beneficiary is an entity, such as an estate, charity or trust that is not a see-through trust.

The 10-Year Rule at a Glance

The final RMD regulations, released in July 2024, reflect changes made by both the SECURE Act and the SECURE 2.0 Act. The regulations confirm the following information:

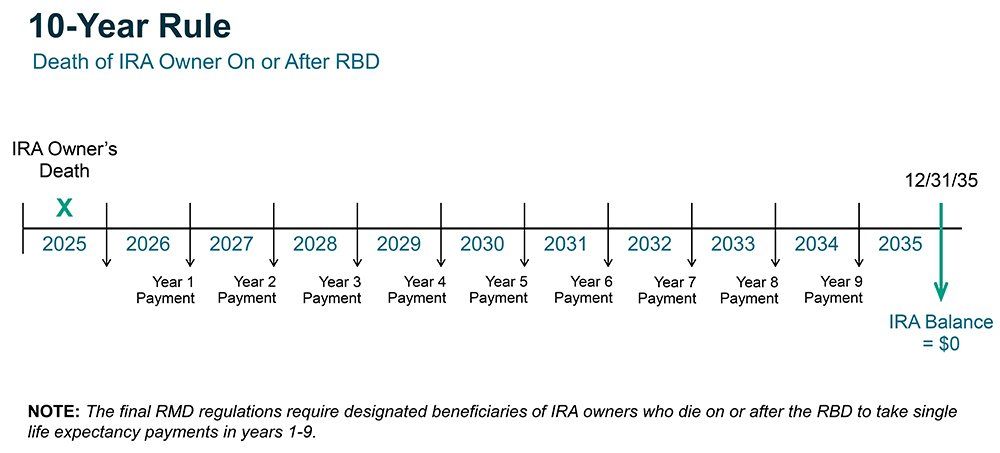

- Designated beneficiaries are required to deplete the inherited account by Dec. 31 of the year containing the 10th anniversary of the account owner’s death.

- Designated beneficiaries of account owners who die on or after the required beginning date (RBD)1 must take annual life expectancy payments during the first nine years and a total distribution by Dec. 31 of the year containing the 10th anniversary of the account owner’s death.

- Eligible designated beneficiaries cannot choose the 10-year rule if death occurred on or after the decedent’s required beginning date (RBD).

Who Can or Must Use the 10-Year Rule?

The 10-year rule applies to certain beneficiaries who inherit funds on or after Jan. 1, 2020. Not every class of beneficiary is limited to the 10-year rule.

- A designated beneficiary’s only option (apart from a lump-sum distribution) is the 10-year rule.

- An eligible designated beneficiary can only select the 10-year option if the account owner died before the RBD or if the funds were in a Roth IRA.

- A see-through trust that has a designated beneficiary (i.e., an individual who is not an eligible designated beneficiary) is subject to the 10-year rule.

- An account owner’s minor child may – as an alternative to the 10-year rule – take life expectancy payments beginning in the year after death but must disburse under the 10-year rule once they reach age 21. If death occurred before the RBD and the minor child was taking life expectancy payments, those annual payments must continue in years one through nine.

Who Cannot Elect the 10-Year Rule?

- An eligible designated beneficiary cannot elect the 10-year rule if the account owner died on or after the RBD.

- A see-through trust that has all eligible designated beneficiaries cannot elect the 10-year rule if the account owner died on or after the RBD.

- A nonperson beneficiary cannot elect the 10-year rule.

The following chart summarizes when the 10-year rule is available.

| Type of Beneficiary | Death before RBD or Roth IRA | Death on or after RBD |

| 10-year rule with no annual payments | 10-year rule with annual payments | |

| Eligible Designated Beneficiary | Yes | not available |

| Designated Beneficiary | Only Available Option | Only Available Option |

| Nonperson Beneficiary | not available | not available |

| See-through Trust | Yes | not available when all beneficiaries are Eligible Designated Beneficiaries |

NOTE: Beneficiaries may choose to take a lump-sum distribution at any time.

When Are Annual Life Expectancy Payments Required?

This is a common question that arises from the 10-year rule. When it was first introduced by the SECURE Act of 2019, the original interpretation by many in the retirement industry was that annual life expectancy payments were not required under the 10-year rule. The final Required Minimum Distribution (RMD) regulations confirm that this is true for beneficiaries of account owners who die before the RBD and beneficiaries of Roth IRA owners. These individuals may take distributions in any amount at any time as long as they deplete their portion of the account by Dec. 31 of the year containing the 10th anniversary of the account owner’s death.

The final RMD regulations also confirm that designated beneficiaries of account owners who die on or after the RBD must take annual life expectancy payments in years one through nine. Beneficiaries are not limited in the amount that they can withdraw in any year; they can always take out more than the minimum amount, penalty free.

For information on how to calculate life expectancy payments, refer to Figuring the Beneficiary’s RMD section in IRS Publication 590-B, Distributions from Individual Retirement Arrangements (IRAs).

Penalty Tax and Previous Relief

Beneficiaries who fail to take a required life expectancy payment are subject to an excess accumulation penalty tax equal to 25% of the amount that should have been taken but was not.2 If the failure is corrected in a timely manner, the penalty tax is reduced to 10%. A client may request a waiver for the penalty tax under Instructions for Form 5329 Additional Taxes on Qualified Plans (Including IRAs) and Other Tax-Favored Accounts.

Because of the confusion surrounding the 10-year rule, the IRS did not enforce the excess accumulation penalty tax for designated beneficiaries who were required to take life expectancy payments under the 10-year rule in years 2021 through 2024, as stated in IRS Notices 2022-53, 2023-54 and 2024-35.

This relief was only available to designated beneficiaries if:

- the account owner died on or after the RBD in 2020-2023; and

- the designated beneficiary was not taking life expectancy payments.

The same relief also applied to successor beneficiaries of an eligible designated beneficiary if:

- the eligible designated beneficiary died in 2020-2023; and

- that eligible designated beneficiary was taking life expectancy payments.

The relief from the excess accumulation penalty tax has expired, effective Jan. 1, 2025.

FOOTNOTES

- The Required Begin Date is the latest date at which a retirement plan participant may start taking distributions, according to the statute. Retirement plans may require participants to begin taking distributions at any point between the normal retirement age (as of this writing, typically age 65) and the statutorily required begin date).

- For taxable years before 2023, the excess accumulation penalty tax was 50% of the RMD amount that was not taken.

Ascensus is an associate member of the Indiana Bankers Association. Contact a member of the team at ERISAcommunications@Ascensus.com.