Build America Bonds were created as part of the 2009 American Recovery and Reinvestment Act. BABs are federally taxable municipal bonds issued during 2009 and 2010 for which up to 35% of the borrowing costs are federally subsidized either through payments to the issuer as Direct-Pay BABs or through payments to bondholders as Tax Credit BABs. The IRS estimates that more than $181 billion of BABs were issued by state and local governments, and Bloomberg data suggests that about $116 billion of BABs were still outstanding as of March 2024.

Direct-Pay BABs often contain Extraordinary Redemption Provisions, which are usually triggered by a material adverse change in the subsidy. The exact language varies amongst different bonds with some having precise definitions of what constitutes a material adverse change while others contain more vague verbiage. For the latter category, it has been widely viewed that the federal subsidy cuts stemming from the Budget Control Act of 2011, commonly known as sequestration, resulted in a material adverse change to the subsidy and, therefore, triggered the ERP.

Extraordinary redemptions of BABs have occurred each year since sequestration first started in 2013, but the amount called each year has been rather low until recently. There has been a noticeable uptick in BAB redemptions so far in 2024, and some analysts expect many more to be called later this year. Investors may be puzzled as to why issuers are choosing to redeem their BABs now if the ERP was triggered in 2013, and there are several reasons contributing to this trend:

- A court ruling clarifying that sequestration constituted an “extraordinary event.”

A recent court decision, Indiana Municipal Power Agency v. U.S., supports the conclusion that federal budget sequestration cuts resulted in an extraordinary event that triggered many ERPs. This decision provides the clarity some issuers need to proceed with redeeming their BABs using the ERP.

- Make-Whole call prices have fallen as market rates have increased.

The price at which a bond may be redeemed is stated in the prospectus for each bond. It can be at par, at a premium or at a make-whole call price. Make-Whole call prices provide investors with the net present value of the future principal and interest payments, calculated using a specified benchmark rate plus a spread as the discount rate. Make-Whole call options are rarely exercised because they are usually very costly for the issuer, but higher interest rates result in a higher discount rate and a lower present value payment. Hence, a lower call price in current market conditions.

- Market dynamics favor refinancing taxable debt with tax-exempt debt.

Municipal-to-Treasury ratios, a common measure of relative value of tax-exempt municipal bonds, for most terms have fallen significantly with some nearing or reaching record lows. This has enabled some issuers to find savings by refinancing taxable BABs with tax-exempt debt despite the interest rate hikes in recent years.

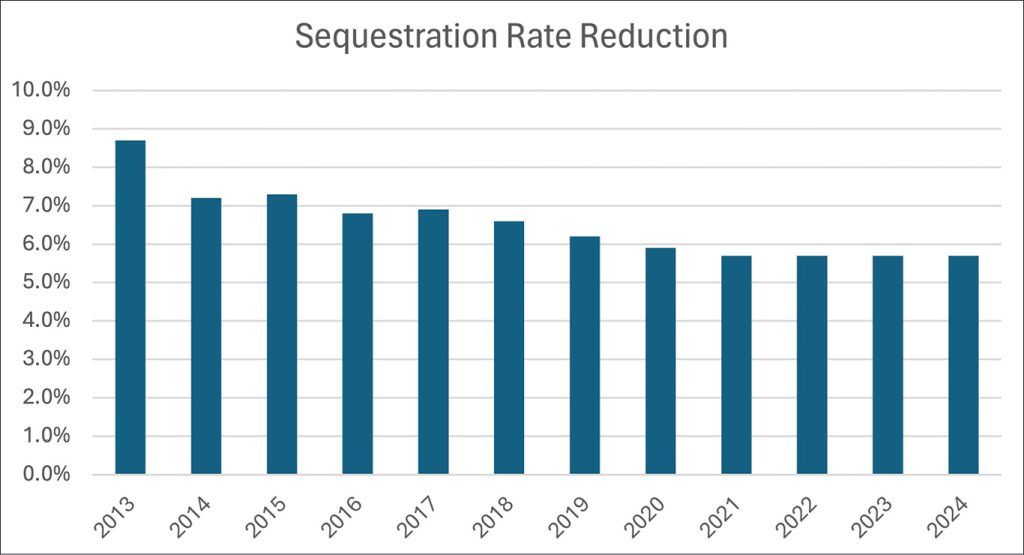

Further, issuers may want to reduce the risk of additional cuts in the federal subsidy by refinancing BABs with tax-exempt debt. The chart below shows the history of the subsidy cuts according to the IRS.

The Municipal Securities Rulemaking Board noted in a recent brief that it has observed “a number of BABs trading in the secondary market at a significant premium to par.” Spreads have widened somewhat as these redemptions have become a more prominent issue, which indicates the market may be starting to recognize an increase present in the call risk. However, investors who own or purchase BABs at a premium price may be at risk of realizing losses due to early redemption if the issuer chooses to exercise an extraordinary redemption call option. Fortunately, today’s higher interest rate environment provides opportunities to favorably reinvest the redemption proceeds, which is rather uncommon given that redemptions are usually more frequent in falling rate scenarios.

These circumstances highlight the importance of investors researching and understanding all applicable redemption provisions, particularly when purchasing municipal bonds at prices above par. This information can be found within the prospectus and should be provided on pre-purchase offering documentation as well.

Dana Sparkman, CFA, is senior vice president, municipal analyst in The Baker Group’s Financial Strategies Group. She manages a municipal credit database that covers more than 150,000 municipal bonds, providing clients with specific credit metrics essential in assessing municipal credit.

Email Dana at Dana@GoBaker.com.

The Baker Group is a Preferred Service Provider of the Indiana Bankers Association and an IBA Diamond Associate Member.