Repayment capacity measures include the capital debt repayment capacity, capital debt repayment margin, replacement margin, term debt and capital lease coverage ratio, and replacement coverage ratio.1 Capital debt repayment capacity, capital debt repayment margin, and the term debt and capital lease coverage ratio address a farm’s ability to repay operating loans and to cover the current portion of principal and interest due on noncurrent loans such as a machinery, building or land loan. The replacement margin and the replacement margin coverage ratio enable borrowers and lenders to evaluate whether a farm has sufficient funds to repay term debt and replace assets.

For a farm to grow, it is essential that the replacement margin be large enough to repay term debt, replace assets, and purchase new assets, and that the replacement coverage ratio be greater than one. This article defines and illustrates the use of key repayment capacity measures.

The capital debt repayment capacity margin is computed by subtracting interest expense on term debt, principal on term debt and capital leases, and unpaid operating debt from prior periods from capital debt repayment capacity. To compute this measure, a farm subtracts family living withdrawals and income and self-employment taxes from a subtotal consisting of accrual net farm income, off-farm income and depreciation. The capital debt repayment margin enables borrowers and lenders to evaluate the ability of a farm to generate the necessary funds to repay the current portion of the term or noncurrent debt. For this to happen, accrual net farm income, off-farm income and depreciation must be large enough to cover family living withdrawals, income and self-employment taxes, principal and interest on term debt, and unpaid operating debt from prior periods.

The term debt and capital lease coverage ratio is closely related to the capital debt repayment margin. To compute this ratio, divide capital debt repayment capacity by principal and interest on term debt. A ratio greater than one indicates that the farm has enough funds to cover principal and interest on term debt.

The replacement margin and the replacement margin coverage ratio take the analysis one step further. The replacement margin is computed by subtracting cash used for capital replacement from the capital debt repayment margin. This measure enables a borrower to evaluate a farm’s ability to repay term debt and replace assets. It can also be used to evaluate a farm’s ability to acquire additional assets.

Cash used for capital replacement can be measured using actual capital purchases (more specifically, the portion of capital purchases that need to be paid for in the first year) or depreciation. The idea behind using depreciation is straightforward. Depreciation represents wear and tear, and obsolescence of machinery and buildings. Over the long run, a farm needs to be able to replace machinery that is wearing out, afford new technology and expand.

We typically recommend using depreciation plus another 10-20% of depreciation as the farm’s measure of cash used for capital replacement. This amount will likely not be covered every year. However, over the long run, it is essential that the replacement margin be positive. Without a positive replacement margin, a farm will not be able to fully replace depreciable assets or grow.

The replacement margin coverage ratio is closely related to the replacement margin. To compute this ratio, divide capital debt repayment capacity by the sum of principal and interest on term debt, unpaid operating debt in prior periods and cash used for capital replacement. If the replacement margin coverage ratio is greater than one, the farm has sufficient funds to repay term debt and replace assets.

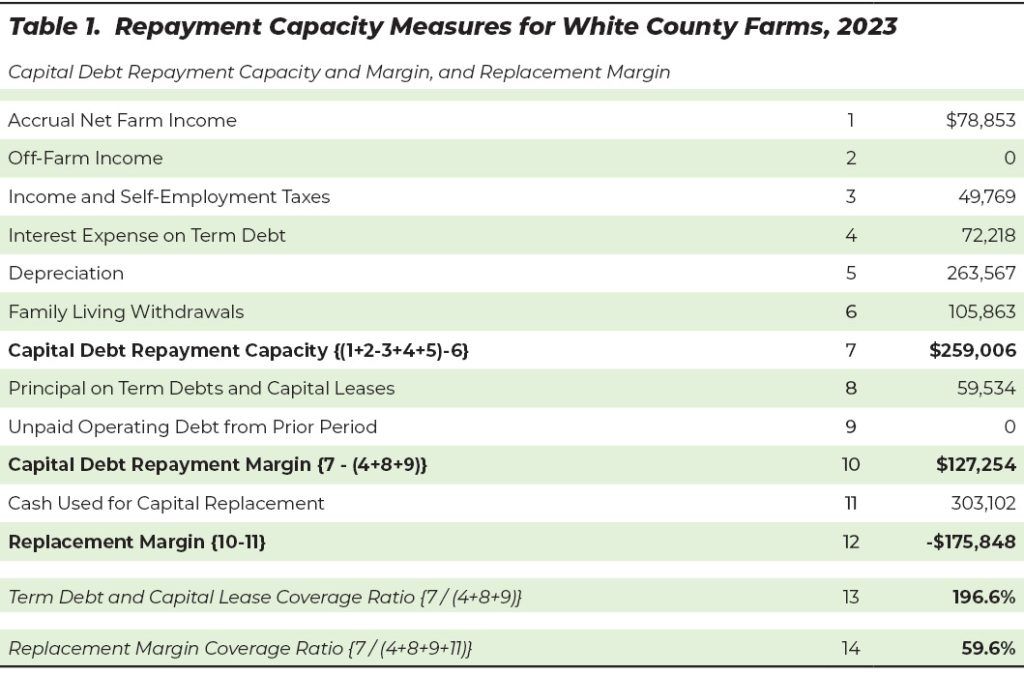

Table 1 provides an illustration of the repayment capacity measures discussed above for a case farm in west central Indiana. This case farm has 3,000 acres of corn and soybeans. Cash used for capital replacement was computed by multiplying depreciation by 1.15. This ensures that there are enough funds available long-term to replace equipment and to expand.

Capital debt repayment capacity for the case farm is $259,006. This amount was large enough to cover principal and interest on term debt. Consequently, the farm’s capital debt repayment margin was a positive $127,254. The replacement margin was negative, though, indicating that the farm did not generate enough funds in 2023 to cover both term debt obligations and to replace assets. This is also signified by a replacement margin coverage ratio that is less than one or less than 100%.

Because of the negative projected replacement margin in 2023, it is important for this farm to evaluate whether the replacement margin is positive over the long run. The average replacement margin from 2007 to 2023 for the case farm was $230,414, indicating that the farm had the ability to cover both term debt obligations and replace assets during this period. For this farm to expand in the future, the average replacement margin over the next five to ten years will also need to be positive.

FOOTNOTES

- “Financial Guidelines for Agriculture, January 2017.” (Farm Financial Standards Council)

Michael Langemeier, Ph.D., Associate Director, Center for Commercial Agriculture

Purdue University

Michael is the director of cropping systems for the Center for Commercial Agriculture in the Department of Agricultural Economics Department at Purdue University. His extension and research interests include agricultural finance, cost of production, leasing principles and transition planning. Michael teaches courses in farm financial management and tax planning strategies.

Email Michael at MLangeme@Purdue.edu