Consumer deposit fee trends reversed course in the first quarter as larger banks that had been shrinking fees expanded them and smaller banks with higher reliance pulled back.

In recent years, the industry’s consumer deposit fee income has consistently shrunken as the largest U.S. banks faced intense regulatory and competitive pressure to change their overdraft policies. While some of that pressure trickled down to community banks, most kept their overdraft policies intact.

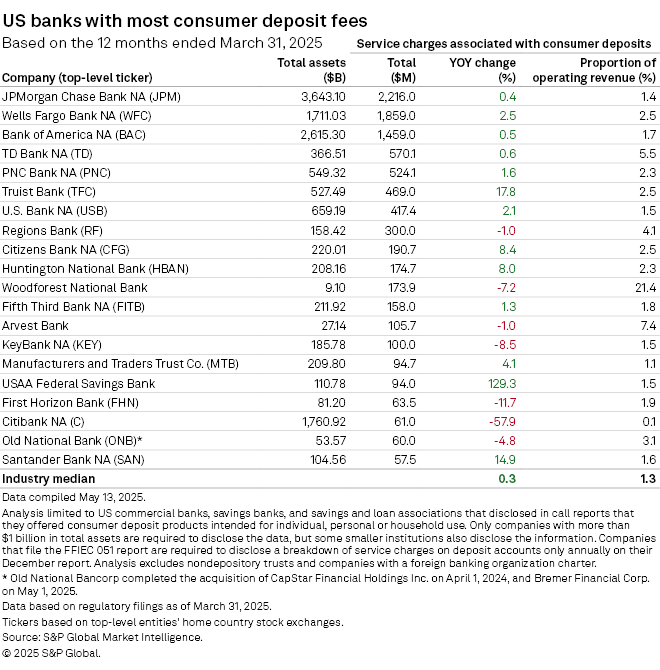

But that trend reversed in the first quarter when 13 of the 20 banks with the most consumer deposit fee income posted higher consumer deposit fee income levels year over year for the 12 months ended March 31. That upward movement was mostly concentrated among the largest banks, as nine of the 10 banks with the most consumer deposit fees posted year-over-year growth.

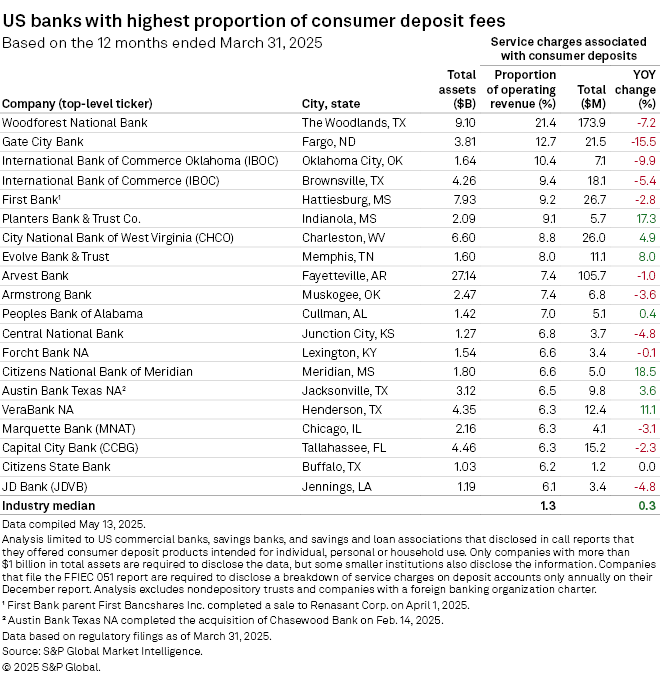

At the same time, smaller banks that were most reliant on these fees lost ground. During the same time period, 12 of the 20 U.S. banks with the highest proportion of consumer deposit fees decreased those fees.

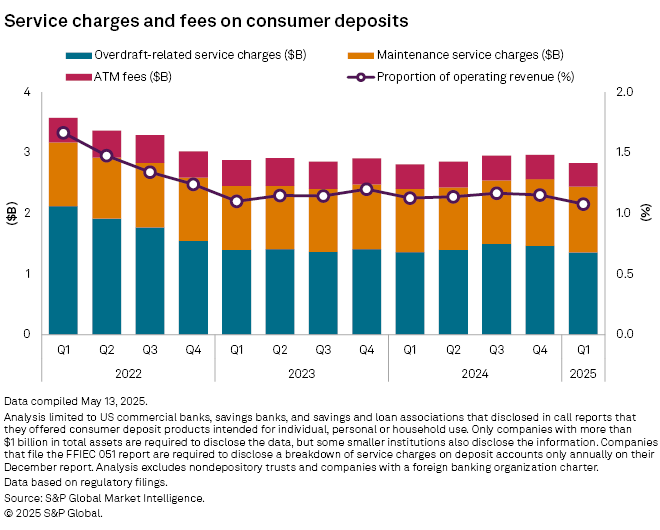

Altogether, the industry collected fewer consumer deposit fees sequentially. U.S. banks’ consumer deposit fees totaled $2.83 billion in the first quarter, down from $2.96 billion in the linked quarter. Much of that drop came from overdraft fees, which dropped to $1.36 billion from $1.46 billion in the fourth quarter of 2024.

As a result, consumer deposit fees as a proportion of operating revenue for the industry also dropped to 1.08% from 1.15% in the prior quarter.

The industry grew consumer deposit fee income by a median of 0.3% year over year for the 12 months ended March 31. Most of the top 20 banks by most consumer deposit fees posted growth well above that median.

Among the list, USAA Federal Savings Bank posted the most growth at 129.3%. Truist Bank posted the second-highest increase, up 17.8%.

The nation’s three largest banks — JPMorgan Chase Bank NA, Wells Fargo Bank NA and Bank of America NA — also posted year-over-year consumer deposit fee income growth. Among them, Wells Fargo logged the biggest increase at 2.5%.

Among the top 20 consumer deposit fee gatherers, just seven reduced their fee income line year over year. Citibank NA’s fees dropped the most, down 57.9%.

For banks where consumer deposit fees made up the largest proportion of operating revenue, most shrunk year-over-year balances.

Gate City Bank, which recorded the second-highest proportion at 12.7%, had the highest year-over-year deposit fee income drop. Its fees fell 15.5% for the 12 months ended March 31.

International Bank of Commerce Oklahoma posted the second-highest drop in fees, down 9.9% year over year to 10.4% of operating revenue.

Woodforest National Bank, which almost always tops the list for the highest proportion of consumer deposit fees to operating revenue, saw consumer deposit fee income drop 7.2% year over year.

Of the group, seven banks increased consumer deposit-related service charges yearly, with Citizens National Bank of Meridian rising the most, up 18.5%. Planters Bank & Trust Co. followed with its fees rising 17.3% in the 12 months ended March 31.

Claire Lawson, Community Banking Reporter, S&P Global Market Intelligence

Claire’s coverage for S&P’s U.S. Financial Institutions Group includes community banking trends, banking research pieces, breaking news and day-two stories, which can be found on the CapIQ Pro desktop’s Financial News tab. Based in Washington, D.C., she earned a bachelor’s degree from Virginia Tech.

Email Claire at Claire.Lawson@SPGlobal.com

Ronamil Portes, Specialist, S&P Global Market Intelligence

Ronamil’s data dispatch coverage for S&P’s U.S. Financial Institutions Group includes topics related to U.S. banks and thrifts such as consumer deposit fees and M&A activity. Based in the Philippines, she earned a bachelor’s degree from the University of Santo Tomas and a master’s from the University of the Philippines-Diliman.

Email Ronamil at Ronamil.Portes@SPGlobal.com

S&P Global Market Intelligence is an IBA Preferred Service Provider.